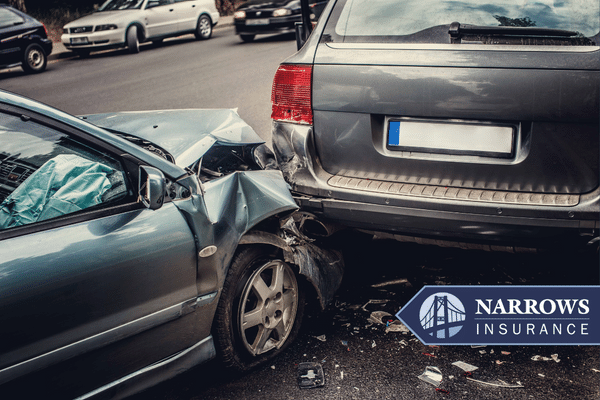

Car Insurance

Insurance is designed to protect you from the expenses of unexpected and unavoidable life events. Having a car insurance policy that is designed to fit your needs is a great way to protect yourself from unforeseen events. Our independent insurance professionals have the ability to shop insurance for you to find competitive coverage in the marketplace.

Understand Your Auto Insurance Before the Unexpected Happens

Important Auto Insurance Coverages

- Bodily Injury Liability

- Property Damage

- Personal Injury Protection & Medical Payments

- Uninsured/Underinsured Motorist

- Comprehensive (other than collision)

- Collision (Collision with other vehicle/objects)

Auto Insurance Discounts

- Multipolicy

- Mutli-Car

- Low Mileage

- Advanced Quote

- Telematic Device

- Accident Free/Violation Free

- AARP Member Discount

Bodily Injury Liability

This type of coverage pays for injuries and/or harm to others in an accident that you are found liable for.

Example: You accidentally run a red light and collide with another car in the intersection. The occupants of the other car suffer broken bones and other various injuries. They end up going to the hospital and have multiple surgeries. Your bodily injury liability insurance will cover the cost of the medical bills and other costs associated with the injuries sustained. Without insurance, you have to pay for these bills out of pocket, which could easily reach into the hundreds of thousands if there are multiple people involved.

Property Damage Liability

This type of coverage pays for damage to other peoples' property caused by your automobile.

Example: You are driving your car and hit a patch of ice causing you to lose control and smash into your neighbor's fence. You caused the damage to their property with your automobile. Without property damage liability coverage, you would have to pay for the fence out of pocket. With insurance, you just have to pay your deductible and the rest is covered by the insurance company.

Uninsured Motorist / Underinsured Motorist

Liability coverage to protect you when another party injures you or causes harm to you when they either don't have insurance, or don't have enough to cover the damages.

Example: You are driving down the freeway and a car side-swipes you. You pull over and find out that they don't have insurance. Your uninsured motorist coverage will pay for your medical bills and to repair the damage to your vehicle.

This type of coverage helps make sure that you are not left with significant financial burdens because someone else does not have the proper insurance.

Personal Injury Protection & Medical Payments (No-Fault Coverage)

Coverage that pays for you and your passengers medical and related expenses from a car accident regardless of who is at fault.

Example: You are involved in a car accident and sustain injuries that you need immediate attention for, such as a broken arm. With this kind of coverage, the insurance company will pay for your hospital visit. This is a valuable type of coverage because it gives you the ability to get medical care that is paid for by the insurer, regardless of who is at fault for the accident (which can sometimes take a while to determine).

Comprehensive Coverage (Other-Than-Collision/OTC)

Comprehensive coverage pays for damage to your vehicle that is not from a collision. It will pay the fair market value for your car to be repaired or replaced. Comprehensive is not required by the state to carry, but typically is required if your vehicle is financed or leased.

Examples of damage not resulting from collision: theft, vandalism (such as someone keying your car), falling objects (such as a tree or tree branch), flood, etc.

Collision Coverage (Collision with other cars or objects)

Collision is physical damage caused to your vehicle in an automobile accident that occurs in a direct collision with another vehicle or object. In a collision, you pay your deductible and get your vehicle repaired or receive the fair market value for your vehicle. Collision is typically required as well if your vehicle is financed or leased.

Other Coverage Options

- Rental Car Reimbursement - Covers your rental car expense in the event of an accident or covered loss

- Roadside Assistance & Towing

- OEM Parts - An endorsement you can add for newer vehicles to have Original Equipment Manufacturer (OEM) used to repair your vehicle

- GAP Coverage/Loan Lease - Coverage that will pay the difference between the market value on your vehicle and the loan amount if there was a total loss to your vehicle

Everyone's situation for insurance is unique, so it is important to find insurance that fits your needs. One of our insurance professionals can help assess what your needs are and help design an auto insurance plan that will protect you at an affordable cost. Contact us today for assistance with your car insurance!

Informational statements regarding insurance coverage are for general description purposes only. These statements do not amend, modify or supplement any insurance policy. Consult the actual policy or your agent for details regarding terms, conditions, coverage, exclusions, products, services and programs which may be available to you. Your eligibility for particular products and services is subject to the final determination of underwriting qualifications and acceptance by the insurance underwriting company providing such products or services. This website does not make any representations that coverage does or does not exist for any particular claim or loss, or type of claim or loss, under any policy. Whether coverage exists or does not exist for any particular claim or loss under any policy depends on the facts and circumstances involved in the claim or loss and all applicable policy wording.